How does DeFi Insurance Work?

Table Of Contents

How does Defi Insurance Work? Cryptocurrencies, often hailed as the future of finance, promise lucrative returns for early investors. However, these potentially rewarding investment opportunities are not devoid of risks. The potential return from investments is directly proportional to the risk involved.

In this blog post, we delve into the world of crypto insurance, specifically DeFi (Decentralized Finance) insurance, a tool to mitigate these risks.

Why DeFi Insurance?

The allure of high returns often comes with the uncertainty of achieving those returns. This uncertainty, known as the risk of investments, is particularly high for new-age opportunities like crypto. The crypto ecosystem is not limited to investments alone.

It encompasses an entire financial system developed around cryptocurrencies and smart contracts, including lending and borrowing, trading, crowdfunding, etc., collectively known as DeFi or Decentralized Finance.

Despite DeFi’s revolutionary potential, it adheres to the fundamental investment concept of the risk-return trade-off. Therefore, while it’s crucial to make money from your investment, it’s equally important to minimize the risks. The ideal investment scenario involves high returns and low risks.

Identifying Risks in DeFi Projects

DeFi projects come with three broad categories of risk:

Software Risk: DeFi protocols are software applications that run on the internet with minimal human oversight, often handling millions or billions of dollars. Like all software, DeFi protocols are susceptible to coding errors or bugs that may cause the software to malfunction, and security vulnerabilities that allow hackers to break in and steal funds from the protocol.

Token Risk: Every DeFi investment involves certain cryptocurrency tokens. Like any real-life asset, these tokens don’t have any inherent value, only what people are willing to pay for them and their utility. Therefore, there’s always a risk that the token may become instantly valueless, primarily due to scams.

Fraud Risk: Where there is money, there are scammers, and crypto is no exception. Frauds in the crypto world range from phishing, where a scammer pretends to be an official company to trick victims into revealing sensitive information, to scam airdrops, where protocols distribute free tokens to community members, not all of which are genuine.

The Significance of DeFi Insurance

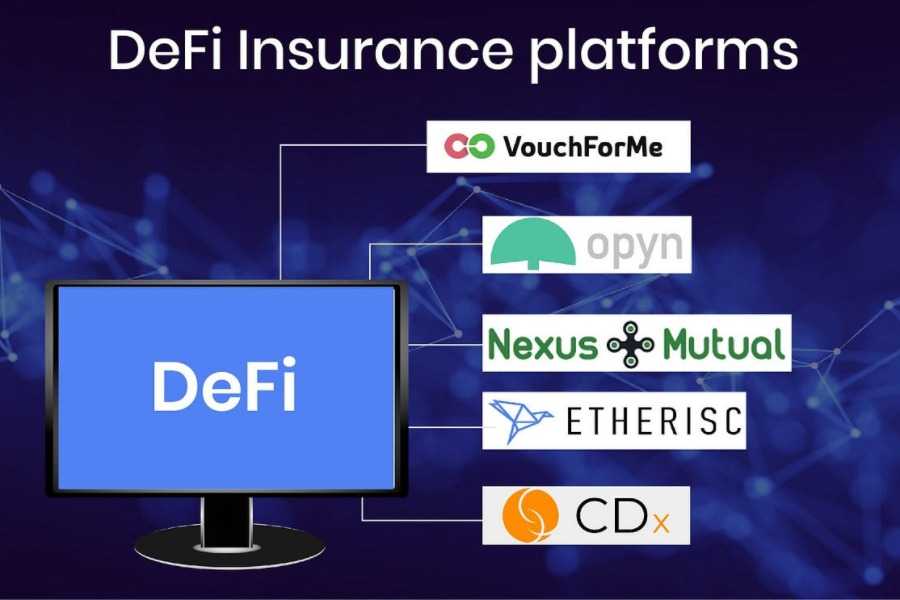

This is where DeFi insurance comes into play. DeFi insurance refers to insuring yourself or buying coverage against losses caused by events in the DeFi industry.

For instance, if you purchase some tokens and lend them to someone else in the protocol, but you are aware that you might lose your capital if the protocol gets hacked or there is a bug in the smart contracts, you would want to insure yourself against this risk.

DeFi Insurance: How Does It Work?

You buy coverage against a specific event, thereby protecting yourself against capital loss due to that specific event. The premium you pay for this coverage depends on multiple factors such as the coverage duration, covered amounts, and the covered event.

On the other side are coverage providers who underwrite your risk, meaning that they cover you in case the underwritten event happens. Coverage providers, therefore, bear risk and earn interest on the capital they provide. Anybody can act as a coverage provider.

The most crucial part of any insurance is its claim verification and processing. Different insurance platforms use different methods to verify claims.

Often this is done by the community itself, which is set up as a DAO (Decentralized Autonomous Organization) structure. In such a structure, holding the token associated with the insurance protocol gives you governance rights, meaning that you can participate in voting to accept or deny claims.

Spotlight on InsurAce: A DeFi Insurance Protocol

InsurAce is a decentralized insurance protocol that aims to protect DeFi investors and users against hackers, smart contract vulnerabilities, and other bugs to make crypto safer for everyone. InsurAce operates on four different chains: Ethereum, Binance, Polygon, and Avalanche, and covers 17 different public chains.

This makes it one of the most widespread insurance protocols, covering over 107 different DeFi protocols with over $230 million worth of coverage.

The Future of DeFi Insurance: A Promising Landscape

The DeFi industry, with a couple of trillion dollars in the crypto market and about $250 billion worth of funds locked into DeFi, has less than 2% insured currently.

With over $3 billion worth of hacks in 2021 alone, up from $120 million in 2020, the need for DeFi insurance is evident. Considering these numbers and the problem that it solves, the opportunity for DeFi insurance seems massive.

Wrapping Up

In conclusion, while the world of DeFi offers exciting opportunities for investors, it also comes with its fair share of risks.

DeFi insurance is a crucial tool that can help mitigate these risks and protect your investments. As the DeFi space continues to grow and evolve, so too will the need for robust and reliable insurance solutions. Stay informed, stay safe, and happy investing!

Tags

Share

Related Posts

Quick Links

Legal Stuff