Cryptocurrency Benefits and Drawbacks?

In the world of finance, cryptocurrency has emerged as a groundbreaking innovation. With Bitcoin leading the pack, numerous other digital currencies have entered the scene, offering new opportunities and challenges for investors and consumers alike.

Let’s delve into the benefits and drawbacks of cryptocurrency, providing a balanced perspective for those interested in this digital revolution.

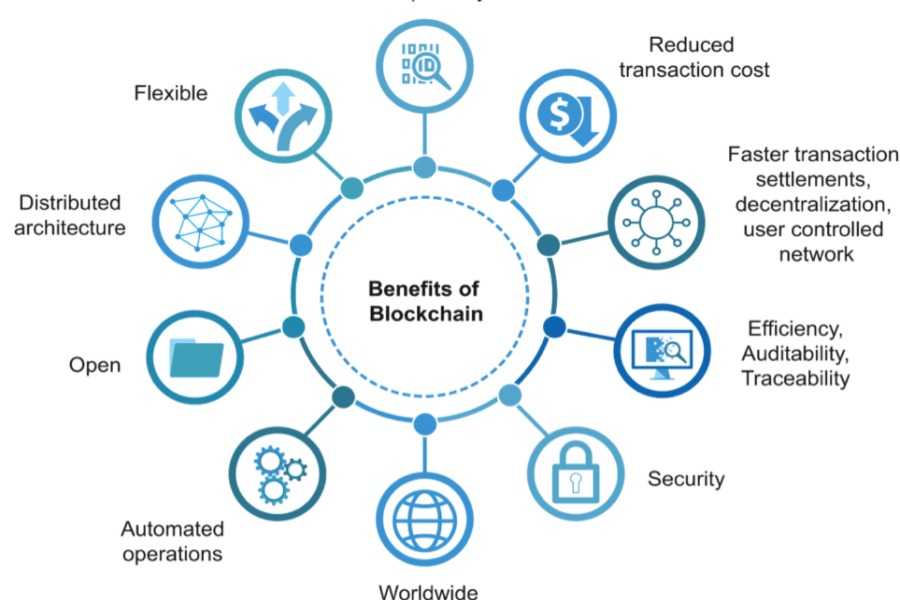

Benefits of Cryptocurrency

Lower Transaction Fees

Traditional banking systems and online money transfers usually involve fees and exchange costs. Cryptocurrencies, however, operate on a decentralized network, eliminating the need for intermediaries and resulting in lower transaction fees. This aspect is particularly beneficial for international transfers and remittances.

Enhanced Security

Cryptocurrencies leverage blockchain technology, which offers a more secure environment than traditional financial systems. The blockchain ledger consists of complex mathematical puzzles, making it extremely difficult for hackers to manipulate. This enhanced security protects users’ identities and transaction details, providing a safer platform for asset transfer.

Decentralization

Cryptocurrencies are decentralized, meaning they are not controlled by any central authority like a government or financial institution. This decentralization ensures that no single entity can manipulate the value of a cryptocurrency, providing a level of transparency and fairness not always seen in traditional financial systems.

Growing Acceptance

The acceptance of cryptocurrency as a valid payment method is growing. More businesses, both online and offline, are beginning to accept cryptocurrencies like Bitcoin, Ethereum, and Litecoin. This growing acceptance enhances the utility and legitimacy of these digital assets.

Protection from Inflation

Traditional currencies are subject to inflation, which can erode purchasing power over time. However, most cryptocurrencies have a finite supply, providing protection from inflation. For instance, the total supply of Bitcoin is capped at 21 million coins, which means its value can potentially increase over time due to scarcity.

Potential for High Returns

Investing in cryptocurrency can yield high returns. For instance, early investors in Bitcoin have seen massive returns on their investment. However, it’s crucial to remember that the potential for high returns comes with a high level of risk due to the volatility of the cryptocurrency market.

Drawbacks of Cryptocurrency

Potential for Illegal Activities

The anonymity provided by cryptocurrencies can be exploited for illegal activities, such as money laundering and illicit purchases. This has led to criticism and scrutiny from regulatory authorities and demands for more robust regulation.

Market Volatility

Cryptocurrencies are notoriously volatile. The value of a cryptocurrency can fluctuate wildly in a very short time, making it possible for investors to experience significant gains or losses. This volatility can make cryptocurrency a risky investment if not managed properly.

Tax Implications

In many jurisdictions, cryptocurrency transactions are taxable. This means that users must keep detailed records of all their transactions and be prepared to pay taxes on them. The tax implications of cryptocurrency transactions can be complex and may require consultation with a tax professional.

Data Loss Results in Financial Loss

In the world of cryptocurrencies, losing your private key means losing your money. If a user loses their private key, they lose access to their cryptocurrency with no way to recover it. This risk underscores the importance of proper key management.

No Cancellation Policy

Cryptocurrency transactions are irreversible. Once a transaction has been added to the blockchain,it cannot be undone. This means if you send cryptocurrency to the wrong wallet, there’s no way to retrieve it. This lack of a cancellation policy can be a significant drawback for those accustomed to the ability to dispute credit card charges.

Potential Mismanagement

Every cryptocurrency is essentially a startup and is only as good as the team behind it. Poor management or a lack of a clear roadmap can lead to a cryptocurrency’s failure. Therefore, it’s crucial to conduct thorough research and due diligence before investing in a cryptocurrency.

Final Thoughts

Cryptocurrencies offer a host of benefits, from lower transaction fees to enhanced security and protection from inflation. However, they also come with significant drawbacks, including their use in illegal activities, market volatility, and the potential for data loss.

As cryptocurrencies continue to evolve, it’s crucial for potential investors and users to understand both the benefits and drawbacks. As always, thorough research and careful consideration should be the foundation of any investment decision.

Remember, the world of cryptocurrency is still relatively new and constantly evolving. Stay informed, be cautious, and never invest more than you can afford to lose. For more insights into the world of blockchain and cryptocurrency, continue exploring explainblockchain.io.

Tags

Share

Related Posts

Quick Links

Legal Stuff