DeFi Lending Pros and Cons

Table Of Contents

Welcome to the world of Decentralized Finance, or DeFi, a revolutionary technology that is reshaping the financial landscape. DeFi refers to a wide range of financial applications based on Bitcoin and blockchain that aim to disrupt financial intermediaries.

In this article, we’ll explore the pros and cons of DeFi lending.

Notable Protocols and Apps in DeFi

DeFi is a vast ecosystem with numerous protocols and apps. Here are a few notable ones:

DEXes (Decentralized Exchanges): DEXes operate without a middleman or an intermediary. Platforms like Uniswap, Curve, and SushiSwap allow users to connect directly with one another to buy and sell crypto in a trustless environment.

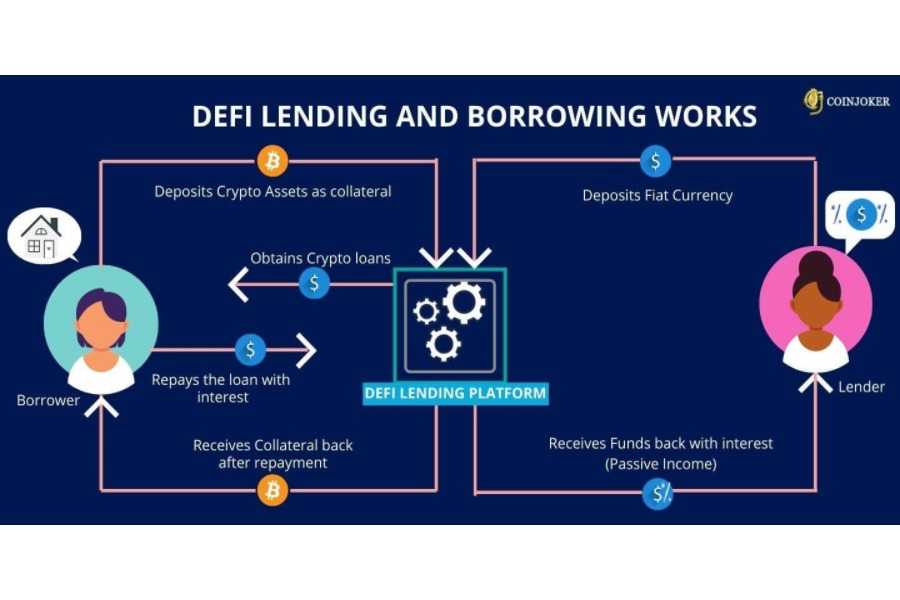

Lending Platforms: Decentralized lending platforms like Maker, Compound, and Aave use smart contracts instead of middlemen, such as banks. This setup allows the borrower and lender to operate in an open environment. Lenders can earn interest on the crypto that is lent out, while borrowers can access liquidity without selling off their own assets.

The Benefits of DeFi

DeFi offers several benefits that are transforming the financial sector:

Permissionless: DeFi opens up the financial system to everyone in the world, regardless of income, race, wealth, culture, or geographic location.

Competitive Interest Rates: Platforms like Compound and Aave allow you to deposit your assets and lend them out to other borrowers. You receive competitive interest rates and can reinvest your capital back into the system.

Unrestrained Control Over Finances: While you do have to deposit your funds into the platform, you decide what happens to them. There are no human intermediaries deciding whether you qualify for a loan or how to manage your investments.

The Drawbacks of DeFi

Despite its benefits, DeFi also has some drawbacks:

Security Issues with Smart Contracts: Smart contracts are open source by default. This design allows prospective users to review them before investing in the DeFi protocol. However, it is not unusual for humans to miss flaws in these contracts, which could be exploited.

Reliance on Oracles: Blockchain protocols can’t access off-chain data, so many of them use oracles, third-party services that provide access to external information. However, this creates a central point of trust in the trustless and decentralized setups.

Bad Actors: The DeFi boom has attracted a bevy of malicious actors. For example, the top crypto exchange KuCoin confirmed that it had suffered a hack that saw $150 million in Bitcoin and ERC-20 tokens transferred from its hot wallets.

The Future of DeFi

The DeFi industry faces the same growing pains as the crypto space as a whole. It’s still in its infancy, with plenty of room for growth. But despite the benefits and returns, it’s still a risky endeavor for the average investor.

Getting Started with DeFi

So, how can you be a part of DeFi? It’s simpler than you might think. All you need to do is set up a digital wallet such as Meta Mask or Trust Wallet, and you’re in the DeFi world. Whether you mine or exchange, buy NFTs, or create your own, the first step is creating your wallet. The rest is your choice.

DeFi: A Long and Bumpy Road Ahead

No matter how capable it is, DeFi has a long and bumpy road ahead. Being an early adopter of DeFi can be beneficial, but it can also be a hindrance. Right now, the possibilities of DeFi are being used as much as possible, generating revenue and keeping people free from banks and governments. However, it’s important to remember that with great potential comes great risk. Always do your research and understand the risks before diving in.

Final Thoughts

DeFi is a revolutionary technology that is reshaping the financial landscape. It offers several benefits, including permissionless access, competitive interest rates, and unrestrained control over finances. However, it also has some drawbacks, including security issues with smart contracts, reliance on oracles, and the presence of bad actors. As always, do your research and understand the risks before investing in DeFi.

DeFi is increasingly being used in both basic and sophisticated financial operations. It is driven by decentralized apps known as DApps or other programs known as protocols. The apps and protocols process transactions in the two most popular cryptocurrencies, Bitcoin and Ethereum. Despite Bitcoin seems to be the most popular cryptocurrency, Ethereum is considerably more flexible to a larger range of purposes, which means that Ethereum-based programming is used in much of the DApp and protocol ecosystem.

The evolution of decentralized finance is still in its early phases. For one, it is unregulated, which means that infrastructure failures, hacks, and frauds continue to plague the ecosystem. Many DeFi users say that blockchains are technologically superior to the current financial system, which is based on obsolete databases and codes.

Decentralizing finance, in part, through reducing the dominance of giant big banks over the economy and markets, might help repair what is wrong with our existing financial system. So how can you be a part of DeFi? All you need to do is to set up a digital wallet such as MetaMask and Trust Wallet, and now you are in the DeFi world.

No matter how capable it is, the DeFi has a long and a bumpy road ahead. Being an early company to DeFi can benefit you, but also it can be a hindrance. Right now, the possibilities of DeFi worth is used as much as possible, generating revenue and keeping people free from banks and governments.

I hope you will have a profitable and safe journey on the DeFi world. That will be all for today. Until then, take care.

Share

Related Posts

Quick Links

Legal Stuff